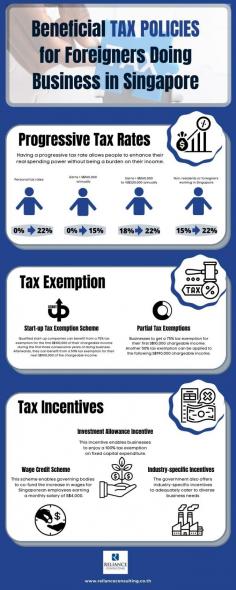

This infographic tells you why entrepreneurs and investors worldwide set up their company in Singapore. Below are some of the most beneficial tax policies they enjoy.

1. Progressive Tax Rates

2. Tax Exemption

3. Tax Incentives

Besides the existing tax incentives, the Singapore accounting body likewise offers corporate loans for businesses that may need additional financial support. And to obtain the ideal scheme for your company, should first consult with professional accounting firms in Singapore. Corporate services Singapore offers a high-quality corporate advisory for both local and foreigner businesses. Learn more about us @ https://www.corporateservicessingapore.com/about-us/

Source: https://www.corporateservicessingapore.com/beneficial-tax-policies-for-foreigners-doing-business-in-singapore/